Consumer Education & Awareness

As per regulatory guidelines, to educate customers, The Gayatri Co-operative Urban Bank Ltd., a leading Co-operative Bank in Telangana and Andhra Pradesh with 64 Branches, has sorted out some of its features with which customer awareness gets improved.

Equated Monthly Instalments (EMI)

EMIs are calculated based on loan repayment tenure and rate of interest availed. EMI is the total amount of principal and interest repayment that is paid on monthly basis for the tenure of the loan as applicable. Once the EMI is paid, the principal component reduces the total loan outstanding amount.

EMI Payments on Due Date & Delayed Payment Charges

The due date of loans will be monthly or quarterly or half yearly as per sanction terms of loan and for working capital loans with daily/weekly repayments, it is as per the repayment schedule. Customers are requested to ensure sufficient amount in their designated bank account at least one day prior to the said due date of EMI repayment as the payment is preferred using NACH.

Delayed Payment Charges

The EMI should be paid within the due dates, otherwise late payment charges will be debited for the delay period. Dishonoured Cheque / Failed NACH would attract both one-time bounce charges at the time of dis-honour as well as late payment charges for the delayed period till the EMI is paid.

Concept of Date of Overdue and NPA

In brief, the EMIs or the repayment dues are expected to be paid on or before the Due Date. Post the Due Date, it becomes overdue. The Non-Performing Assets (NPA) refers to those loans aggregated at the customer level where repayment dues / EMI were not paid on time for a period of more than 90 days.

Classification of Borrower Accounts as SMA/NPA

The Bank recognizes incipient stress in borrower accounts by classifying them as Special Mention Account (SMA)/Non-Performing Asset (NPA) as per the norms given below:

Special Mention Account (SMA)*

Special mention accounts shall be classified as per following categories:

| Loans in the nature of Term Loans | Loans in the nature of cash credit/overdraft | ||

|---|---|---|---|

| SMA sub-categories | Basis for classification-Principal or interest payment or any other amount wholly or partly overdue | SMA sub-categories | Basis for classification-outstanding balance remains continuously in excess of the sanctioned limit or drawing power, whichever is lower, for a period of |

| SMA-0 | Up to 30 days | Up to 30 days | |

| SMA-1 | More than 30 days and up to 60 days | SMA-1 | More than 30 days and up to 60 days |

| SMA-2 | More than 60 days and up to 90 days | SMA-2 | More than 60 days and up to 90 days |

NON-PERFORMING ASSETS (NPA) CLASSIFICATION BASED ON DAY-END PROCESS

Classification of borrower accounts as Special Mention Account (SMA) as well as NPA shall be done as part of day-end process for the relevant date and the SMA or NPA classification date shall be the calendar date for which the day end process is run.

Example: If an account crosses 90 days on due date, say 5th May 2024, then it is classified as an NPA on 5th May 2024.

Non-Performing Asset (NPA)

A non-performing asset (NPA) is a loan or an advance where:

- Interest and/or instalment of principal remains overdue for a period of more than 90 days in respect of a term loan,

- The account remains ‘out of order’ as indicated at paragraph below, in respect of an overdraft/cash credit (OD/CC)

- The bill remains overdue for a period of more than 90 days in the case of bills purchased and discounted

- The instalment of principal or interest thereon remains overdue for two crop seasons for short duration crops

- The instalment of principal or interest thereon remains overdue for one crop season for long duration crops

- The amount of liquidity facility remains outstanding for more than 90 days, in respect of a securitization transaction undertaken in terms of the Reserve Bank of India (Securitisation of Standard Assets) Directions, 2021

- In respect of derivative transactions, the overdue receivables representing positive mark-to-market value of a derivative product, if these remain unpaid for a period of 90 days from the specified due date for payment.

*Agricultural advances governed by crop season-based asset classification shall be exempt from this instruction. ^Any amount due to the bank under any credit facility is overdue, if it is not paid on the due date fixed by the bank.

Out Of Order Status:

Cash credit/Overdraft (CC/OD) account is classified as NPA if it is ‘out of order’. An account should be treated as ‘out of order’ if:

- The outstanding balance remains continuously in excess of the sanctioned limit/drawing power for 90 days.

- In cases, where the outstanding balance in the principal operating account is less than the sanctioned limit/drawing power, but there are no credits continuously for 90 days as on the date of Balance Sheet or credits are not enough to cover the interest debited during the same period, these accounts should be treated as ‘out of order’.

NPA classification on account of non-renewal of CC/OD limits::

An account where the regular/ad hoc credit limits have not been reviewed/renewed within 180 days from the due date/date of ad hoc sanction will be treated as NPA.

NPA classification on non-submission of stock statements:

In working capital borrowal account, Bank relies upon stock statements not older than three months for determination of drawing power. The outstanding in the account based on drawing power calculated from stock statements older than three months, would be deemed as irregular. Account will become NPA if such irregular drawings are permitted in the account for a continuous period of 90 days even though the unit may be working or the borrower’s financial position is satisfactory.

Example of SMA/NPA

- If due date of a loan account is March 31, 2021, and full dues are not received before the lending institution runs the day-end process for this date, the date of overdue shall be March 31, 2021.

- If it continues to remain overdue, then this account shall get tagged as SMA-1 upon running day-end process on April 30, 2021, i.e. upon completion of 30 days of being continuously overdue. Accordingly, the date of SMA-1 classification for that account shall be April 30, 2021.

- Similarly, if the account continues to remain overdue, it shall get tagged as SMA-2 upon running day-end process on May 30, 2021.

- If it continues to remain overdue further, it shall get classified as NPA upon running day-end process on June 29, 2021.

NPA Upgradation

Loan accounts classified as NPAs can be upgraded as ‘standard’ asset only if entire arrears of interest and principal are paid by the borrower. Any partial amount collected which reduces the number of EMIs pending to less than 3 EMIs, will not result in upgradation of the asset.

Example: An NPA account is having 4 EMIs due. Earlier, if 2 EMIs were collected, then the account was upgraded to Standard asset. As per the Revised norms, only if all the 4 EMIs due are collected in full and the account is rolled-back to X-bucket, the account will be treated as resolved and classified as standard.

Once a loan crosses 90 Days Past Due (DPD), it will be flagged as a NPA in the system on that date. Such flag will be removed only when the asset reaches 0 DPD, i.e., when the entire arrears is cleared or when the loan is settled and closed.

Responsible Lending Conduct:

Through its published website or as appropriate if specific to a customer, The Bank will give Notice to its Borrower(s), of any change in the terms and conditions of the sanction. The Bank will also ensure that changes in interest rates, fees and charges are affected only prospectively.

Decision to recall/ accelerate payment or performance under the Agreement will be in consonance with the respective loan Agreement.

The Bank will release all securities of its Borrower only on repayment of all dues by such Borrower, or only on realization of the outstanding amount of the Borrower’s availed limit, subject to any legitimate right or lien for any other claim which The Bank may have against its Borrower. If such right of set off is to be exercised, the Borrower will be given notice about the same with full particulars about the remaining claims and conditions under which The Bank will be entitled to retain the securities till the relevant claim is settled or paid by the Borrower.

The Bank shall release all the original movable / immovable property documents and remove charges registered with any registry within a period of 30 days after full repayment/ settlement of the loan account along with No objection certificate.

The Bank shall give its Borrowers with options of collecting the original movable / immovable property documents either from its branch where the loan account was serviced or from any other office of The Bank where the documents are available, as preferred by the Borrower.

In the event of demise of the Borrowers or Joint Borrowers:

The legal heirs of such Borrowers alone shall be entitled to claim/ collecting the original movable / immovable property documents from The Bank. In such instance, all legal heirs of such Borrower should be physically present in the branch for collecting the original movable / immovable property documents, if all legal heirs of the borrowers are unable to visit the branch, an authorization letter in favour of any one of the legal heirs to be produced. If one or more legal heirs are minors, the natural guardian or the court appointed guardian should collect the documents on behalf of the said minor legal heirs.

The following documents are accepted as valid proof of death and legal heirs of the deceased.

- Death certificate of the title holder issued by respective municipalities

- Legal Heir certificate issued by Revenue authorities / Thasildar or Succession Certificate issued by a jurisdictional court or

- Letter of Administration

- Magistrate/ District Civil court endorsement on an affidavit detailing the legal heirs

- In the event of a dispute among the legal heirs, a court issued Succession Certificate/Letter of Administration alone will be accepted as authenticated proof of legal heirs.

For detailed guidelines in asset classification and provisioning, please refer to RBI’s Master Circular – Prudential Norms on Income Recognition, Asset classification and Provisioning pertaining to Advances dated October 1, 2021, and Prudential norms on Income Recognition, Asset Classification and Provisioning pertaining to Advances – Clarifications dated November 12, 2021. The above asset/SMA classification norms are subject to changes as per regulatory instructions issued from time to time

For Specific Queries customers may please contact the assigned branch.

Nomination

Nomination is the facility available to an account holder to name an individual to receive the proceeds of the account after his/her demise.

What is the feature of nomination?

- An account can have only one individual as nominee.

- It can be made in favour of a minor also.

- Nomination can be made for all types of accounts – Savings, Current, Demat, Recurring and Fixed Deposit.

- A nominee can be added by simply filling up a form and submitting it at any of our branches.

- Addition/modification/deletion of nomination can be made as many times as desired.

Always ask for an acknowledgement after the submission of the nomination form.

In the event of demise of the account holder, the bank shall hand over the proceeds from his/her account to the nominee with minimal documentation.

Phishing

Phishing is an attempt by fraudsters to “fish” for your personal and confidential information, like User ID, Password, etc. through e-mails. This information is then used to take money out of your bank account through a funds transfer.

DO’s and DON’Ts

- Always type the website address. Be wary of clicking on links; they could lead to false websites.

- Do not transact or share confidential data on non-https websites.

- Do not enter your confidential data in any window that may pop-up while you are carrying out a financial transaction online.

- Do not open e-mails or attachments in e-mails sent from people you don’t know.

Online Scams

Fraudsters send attractive offers through letters, e-mails, calls, SMS messages asking you to deposit money to participate in schemes that “sound too good to be true”. Later, they withdraw the money and stop further communication.

Here is a list of the most common frauds:

- Contests and lotteries that you had not registered for, asking you to make a payment for receiving your prize

- Emails appearing to have been sent from large corporations, public institutions and regulatory bodies

- Phone calls or SMSes offering jobs that you had not applied for; intimations of gifts or inheritances supposed to originate from a foreign country, asking you for personal information

- High-yield investment plans and multi-level marketing schemes offering unrealistic returns on investment; please checks the credentials of the person offering these

Banking Ombudsman

The Bank has a process for redressal of its customers’ complaints. The following process is in place:

Customer Care >> Head of Customer Service >> Nodal Officer

If you are not satisfied with the resolution at any of these levels, you may contact the Banking Ombudsman (BO).

The BO is an official appointed by the Reserve Bank of India to resolve the complaints of customers who are unhappy with the resolution given by your bank.

Your communication to the BO should be within one year of the event you are complaining about.

Guide on How to Apply for BO (to edit the link)

Please visit www.rbi.org.in for more information

Credit Score

Credit Score represents your pattern of credit usage and loan repayment history. Credit Scores are maintained by Credit Bureaus.

Here is the process that gets followed, once you apply for a credit card or a loan:

Application for a Loan/Credit Card >> Checking with Credit Bureaus to track repayment history >> Loan accepted/rejected on the basis of credit score and other relevant criteria

Always remember to make your payments on time, clear all pending dues on your loan / credit card and maintain a good credit score.

ATM

You can make your ATM (Automated Teller Machine) operations safe, by observing some simple precautions:

- Memorise your PIN. Do not keep your card and PIN together.

- Do not share your PIN or card with anyone.

- Stand close to the ATM while entering your PIN.

- Do not take the help of strangers for using the card or handling cash.

- Always press the ‘Cancel’ key before moving away from the ATM.

If your card gets stuck in the ATM, or if cash is not dispensed after you have keyed in a transaction, press the ‘Cancel’ key and call your bank immediately.

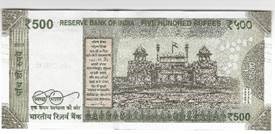

How Well Do You Know Your Currency Notes ?

Know Your Bank Note

₹ 500 denomination banknotes specification

The Reserve Bank of India will shortly issue ₹500 denomination banknotes in Mahatma Gandhi (New) Series with inset letter ‘E’ in both the number panels, bearing the signature of Dr. Urjit R. Patel Governor, Reserve Bank of India, the year of printing ‘2016’ and Swachh Bharat Logo printed on the reverse of the Banknote.

The new ₹ 500 banknotes are different from the earlier specified bank note (SBN) series in colour, size, theme, location of security features and design elements; the principal features are –

- The size is 66mm x 150mm

- The colour is stone grey

- Red Fort-an image of Indian heritage site with Indian flag on the reverse

The banknote also has features (intaglio printing of Mahatma Gandhi portrait, Ashoka Pillar emblem, bleed lines, circle with ₹ 500 in the right, and the identification mark) which enable the visually impaired person to identify the denomination

Update your PAN details

- If valid PAN details are not updated with the bank, tax will be deducted from the interest earned on your deposits at a prevailing rate or 20%, whichever is higher

- If PAN is not updated, you will not be able to obtain your Tax Deduction at Source Certificate (Form 16) from the bank

Central KYC Registry

The Central Registry of Securitisation Asset Reconstruction and Security Interest of India(CERSAI) is entrusted with keeping the KYC records of customers in a Central Repository.

Documents Required for CKYC

- Proof of Identity (PoI)-PAN Card, Aadhar Card, Passport, Driving license, Voter ID,NREGA Job card

- Proof of Address (PoA)-Aadhar Card, Passport, Driving License, Voter ID

- Recent passport size photograph

- PAN Card details

CKYC Identifier & Its Uses

- CKYC Identifier is a unique 14-digit identifier assigned to you based on the KYC details uploaded by your financial institution on CKYCR.

- CKYC Identifier can be obtained directly from any financial institution with whom you have an account-based relationship.

- CKYC Identifier is valid pan India and can be used when opening an account with any financial institution regulated by RBI, SEBI, IRDAI and PFRDA

- Submit the CKYC Identifier whenever you want to start a new financial relationship instead of submitting the same KYC documents (PAN Card, Driving License, Passport, etc.) repeatedly.

- By submitting documents at one place, you can update your KYC details such as contact details, current address, etc. with all the financial institution you have account with.

Benefits of using your CKYC Identifier

- One time KYC compliance / updation for all financial relationships

- Can be used across financial products – Banking, Insurance, Stocks, POPs

- No repeat KYC documentation required.

- Paperless KYC process.

- Your CKYC Identifier can be used PAN India Obtain your CKYC Identifier from your financial institution TODAY.

Customer Care Contact Details

Any grievance or requests of the customer can be brought to the knowledge of the Bank please click here (https://www.gayatribank.in/contact-us/ )