We with our sustained efforts and backed by customer confidence, could still create a name for ourselves in our Area of Operation.

For the first 8 years we had worked as only unit Bank. However with the liberalization of Branch Licensing policy of the RBI in 2008 Year, for Branch expansion in Co-Operative sector, which encouraged branch expansion for the performing Co-Operative Banks, we could get 2 Licenses for Opening of new branches during the Financial Year 2008-09, thereby we are increasing our strength year on year.

Through entering into new locations and acquiring more customers, we are making efforts to stabilize our growth Year on Year, and we could reach to 64 Branches in both Telangana and Andhra Pradesh as of now.

With the active support and guidance of the Regulators, we could continuously perform well and also continued to introduce many new initiatives over a period of time this content600 elf barfind more.

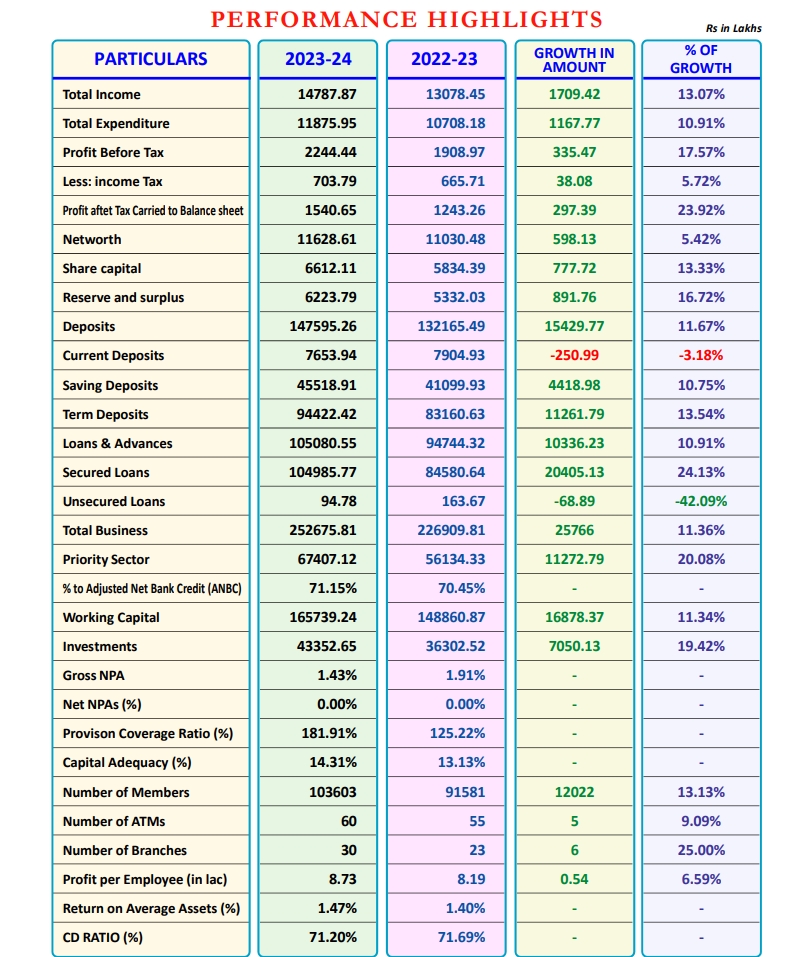

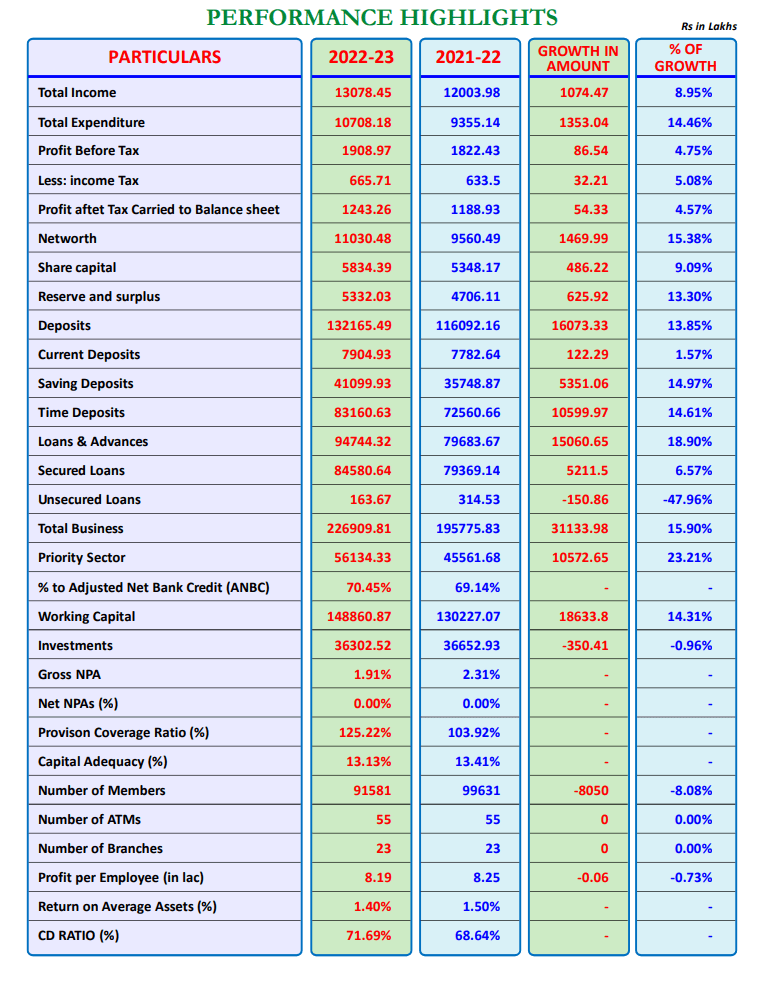

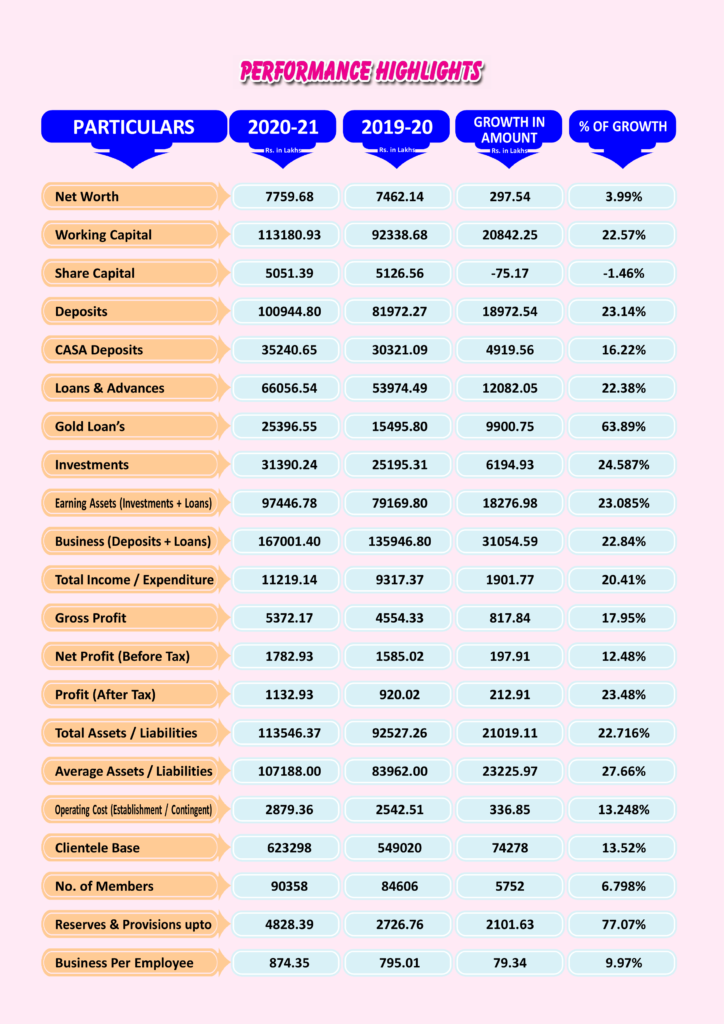

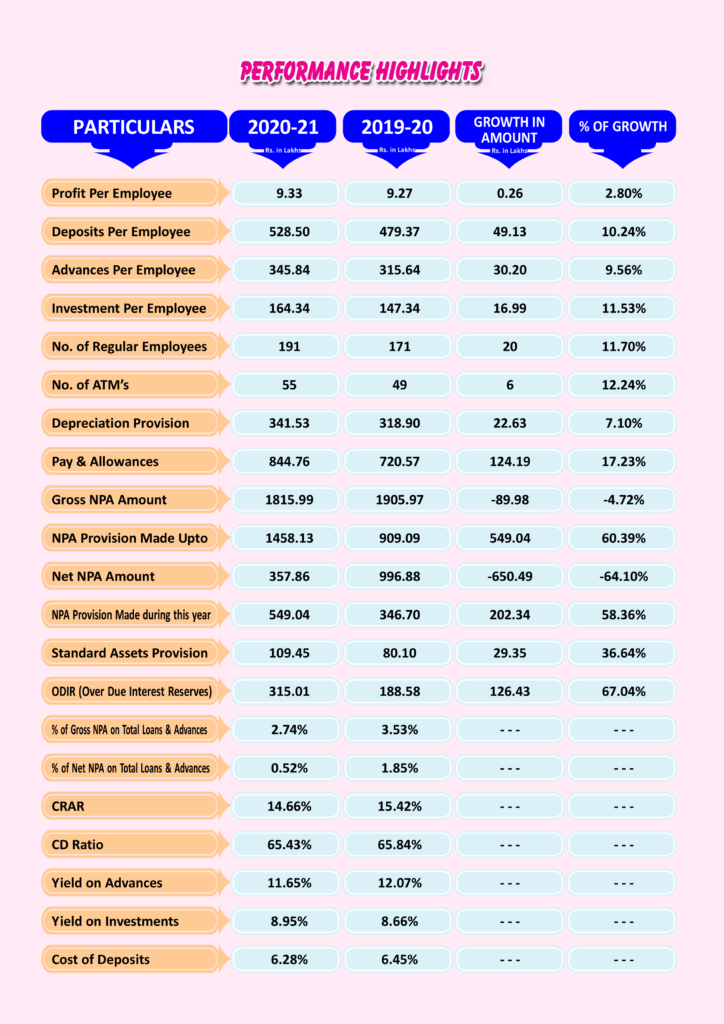

The performance of our Bank during the Financial Year, in regards to various parameters are as under.